Resilient.

Affordable.

Housing.

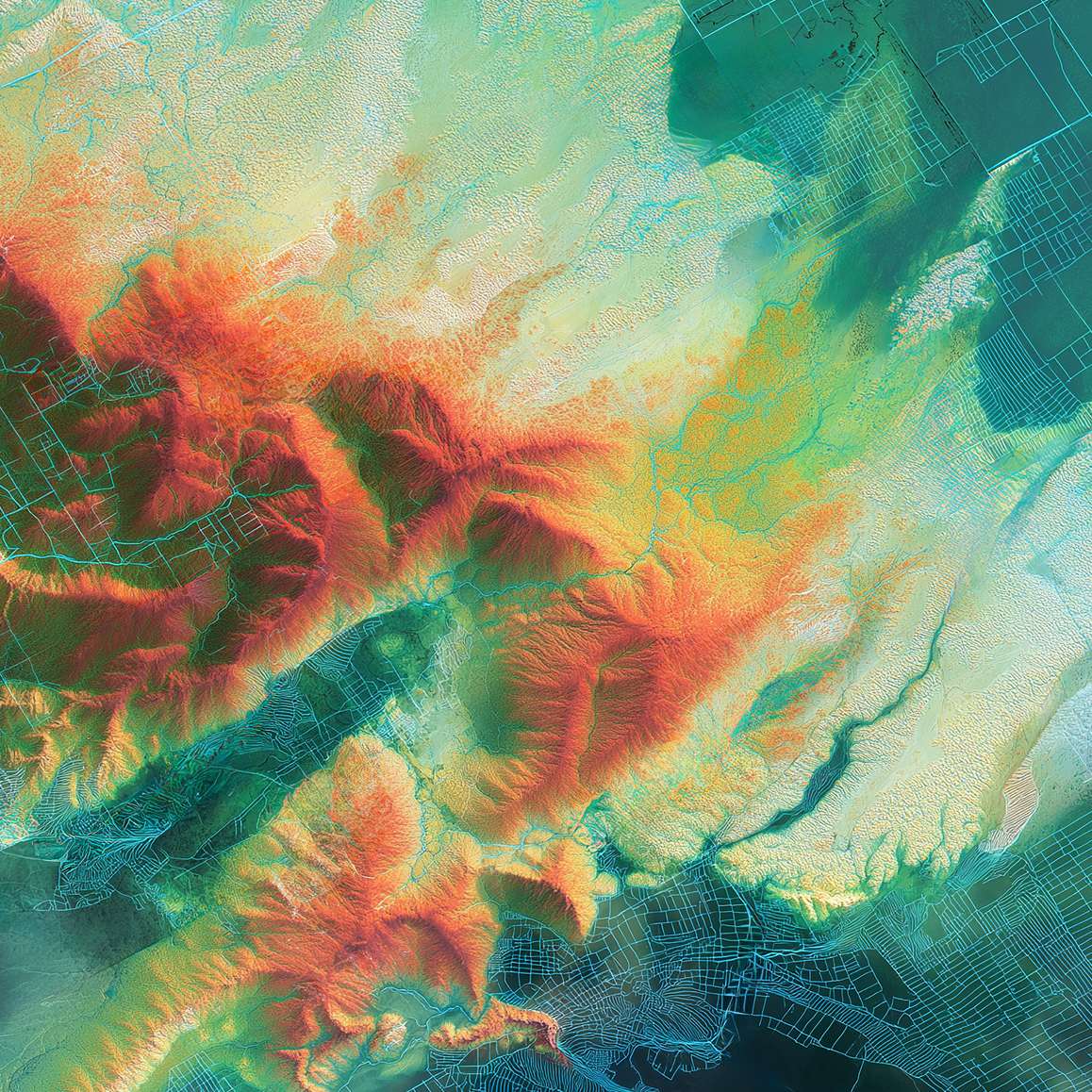

The world’s most valuable asset class is being repriced, with consequences for returns and housing affordability

Housing affordability is already strained in the United States. With insurance costs and utility prices set to continue to rise in this country, the Midwest is uniquely positioned to deliver resilient affordable housing for America’s future.

Sourcing

As one of the few real estate asset managers actively investing in the Great Lakes, our team leverages their extensive industry relationships to source thousands of opportunities each month, including portfolios and individual properties, both on- and off-market.

Diligence

Resilience’s underwriting platform combines “traditional” real estate modeling metrics with alternative data sources, leveraging predictive analytics to more accurately model future behavior for insurance, utilities and demographics enabling us to deploy capital based on where the puck is headed.

Optimization

We don’t just acquire assets—we continuously optimize them. By including energy efficiency, solar and batteries in how we upgrade our properties, we seek to generate additional revenue by selling power to the grid while also delivering low, stable utility costs to residents.

Resilience Investments

Real Estate Portfolios

The Future of Affordability

is Resilience

Rising insurance costs, volatile utilities, and demographic shifts are rewriting the rules of housing affordability. At Resilience Investments, we look beyond today’s price tags and demographic assumptions to invest in housing that delivers resilient returns to our investors and affordability to our residents and the communities we serve.